Understanding Market Volatility

Market volatility is a crucial concept for investors to understand, especially in the context of Finnish and global markets. At Fowenka, we believe that a deep comprehension of market fluctuations is essential for effective risk management and portfolio optimization.

What Drives Market Volatility?

Several factors contribute to market volatility:

- Economic indicators and reports

- Geopolitical events

- Company earnings announcements

- Changes in monetary policy

- Investor sentiment and psychology

Impact on Finnish Markets

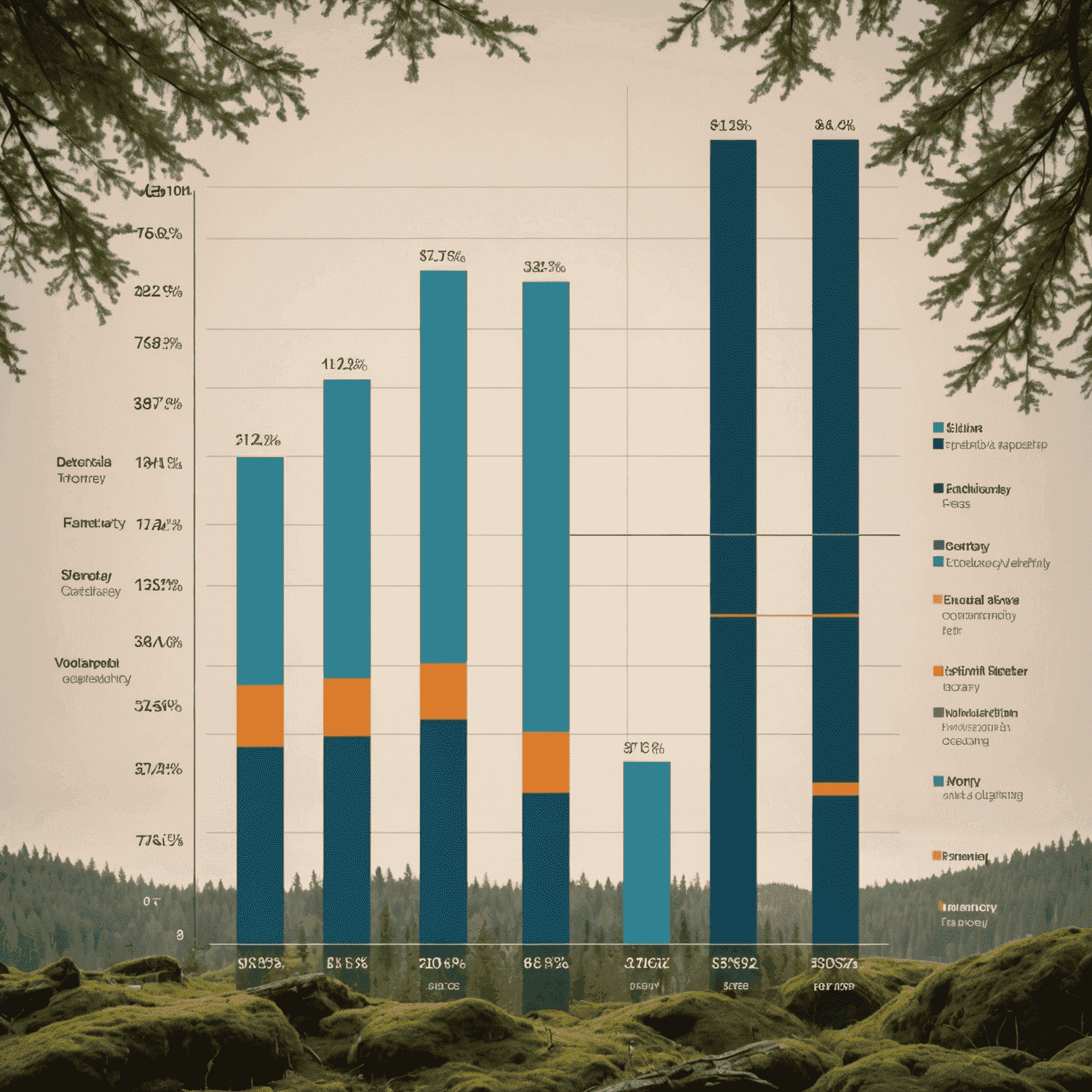

The Finnish market, while relatively stable, is not immune to global volatility. As a small open economy, Finland's market can be particularly sensitive to international trade dynamics and currency fluctuations. Our analysis shows that sectors such as technology and forestry often experience higher volatility due to their export-oriented nature.

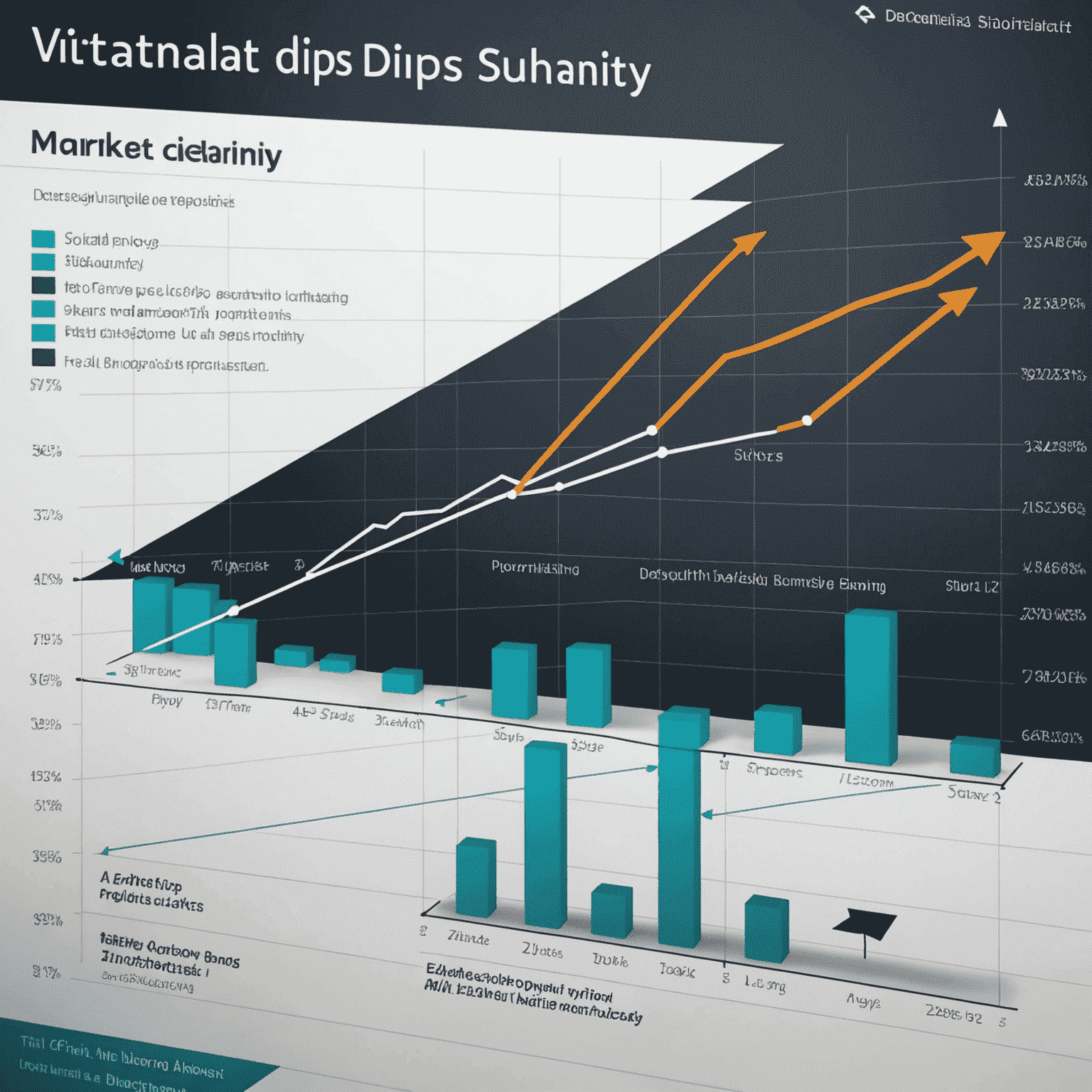

Global Market Interconnectivity

In today's interconnected world, volatility in one market can quickly spread to others. For instance, significant movements in major indices like the S&P 500 or events in large economies like the United States or China can create ripple effects that impact Finnish and other European markets.

Strategies for Managing Volatility

At Fowenka, we recommend several strategies to manage portfolio risk during volatile periods:

- Diversification across asset classes and geographical regions

- Regular portfolio rebalancing

- Implementing stop-loss orders

- Considering defensive stocks or sectors

- Utilizing options strategies for hedging

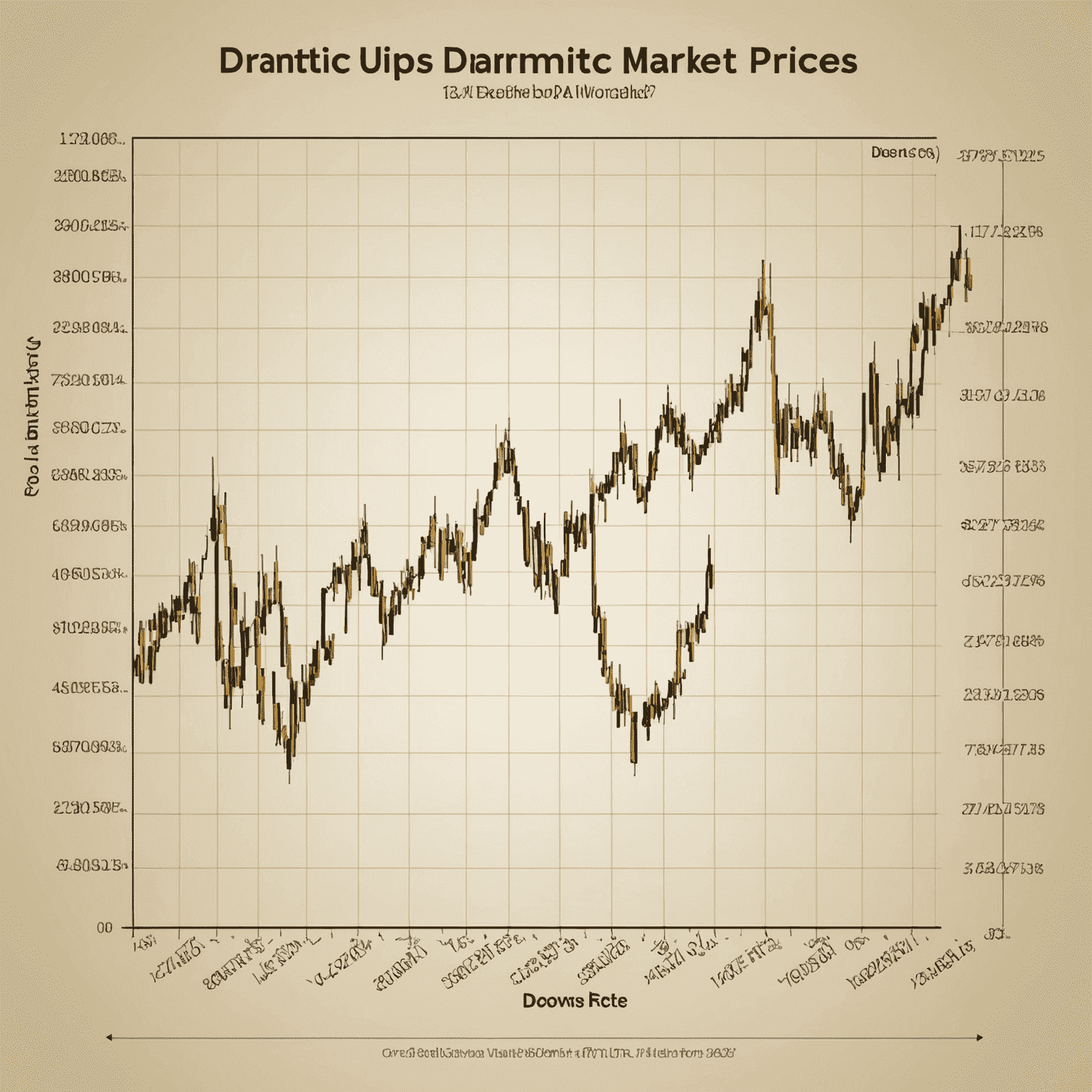

The Opportunity in Volatility

While volatility can be unsettling, it also presents opportunities for savvy investors. Market dips can offer chances to acquire quality assets at discounted prices. Our analysis team at Fowenka continuously monitors market conditions to identify such opportunities for our clients.

Conclusion

Understanding market volatility is crucial for successful investing in both Finnish and global markets. By staying informed, diversifying wisely, and working with experienced analysts, investors can navigate volatile periods more effectively and potentially turn market fluctuations into opportunities for growth.

At Fowenka, we are committed to providing our clients with in-depth market analysis and personalized risk management strategies. Our team of experts is always ready to help you navigate the complexities of market volatility and optimize your investment portfolio for long-term success.